Overapplied overhead definition

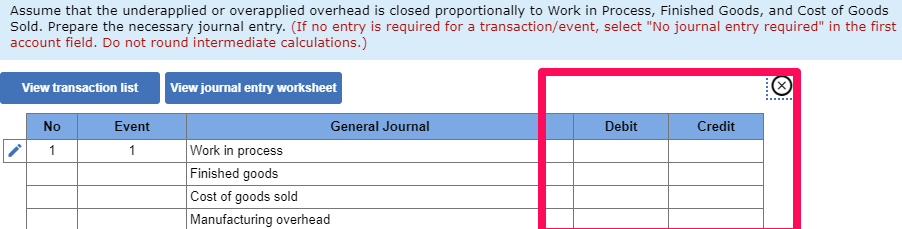

On the other hand, the company can make the journal entry for underapplied overhead by debiting the cost of goods sold account and crediting the manufacturing overhead account. At the end of the accounting period, the balance (whether it’s underapplied or overapplied) is usually cleared out to zero by adjusting the cost of goods sold or other relevant accounts. This way, the effects of under- or overapplying overhead do not carry forward into future accounting what are pre tax payroll deductions and benefits periods. The exact method for dealing with underapplied or overapplied overhead can depend on the specific accounting policies and practices of the company. Since overhead costs contribute to the production of inventory and are incurred throughout the production process, they must be allocated to each job. This means management can’t wait until the end of the period to add up all of the overhead costs incurred and allocate them to each job.

6 Determine and Dispose of Underapplied or Overapplied Overhead

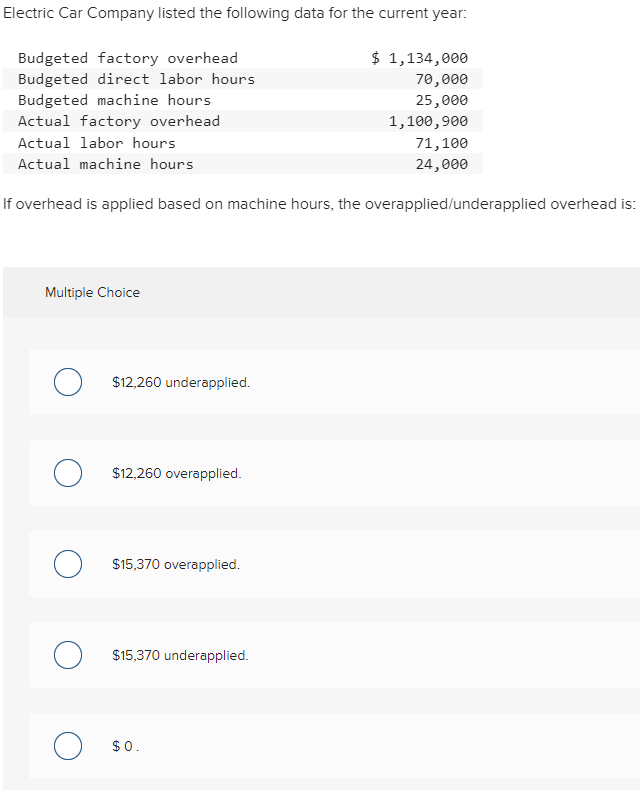

Instead, they start with estimates based on past experience and their expectations for the future. A company might estimate that for the coming year, it will have manufacturing overhead of $250,000 and it will run its machines for a total of 13,000 hours. Underapplied overhead occurs when a company has overhead costs greater than its budgeted costs. Overapplied overhead, on the other hand, occurs when a company has overhead costs less than its budgeted costs. To determine applied overhead, the company needs to know its budgeted overhead and actual overhead.

Overapplied Overhead

The initial predetermined overhead cost rate is calculated by taking the budgeted overhead costs divided by the budgeted activity. During the course of the year many businesses choose to budget and project future expenses. This helps management plan for cash flows throughout the year as well as establish goals. Many businesses book estimated overhead amounts every week or month to evaluate the profitability for the period. For another example, assuming the actual overhead cost that has occurred during the period is $11,000 instead while the applied overhead cost is $10,000, the same as the above example. This journal entry will remove the remaining balance of $500 in the manufacturing overhead account in order to reflect its actual cost of $9,500.

Products

Additionally, it can affect dividend distributions, as companies might distribute more profits than they actually earned, potentially straining cash flows. Since we will be using the concept of thepredetermined overhead rate many times during the semester, letsreview what it means again. Kraken Boardsports had 6,240 direct labor hours for the year and assigns overhead to the various jobs at the rate of $33.50 per direct labor hour. Kraken Boardsports had 6,240 direct labor hours for the year and assigns overhead to the various jobs at the rate of $33.50 per direct labor hour. Job order costing and overhead allocation are not new methods of accounting and apply to governmental units as well. See it applied in this 1992 report on Accounting for Shipyard Costs and Nuclear Waste Disposal Plans from the United States General Accounting Office.

After this journal entry, the balance of manufacturing overhead will become zero. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

What Is Underapplied (vs. Overapplied) Overhead in Budgeting?

The management of overapplied overhead has far-reaching implications for cost accounting practices within an organization. Overapplied overhead often signals that the predetermined overhead rate may need adjustment. This necessitates a thorough review of the allocation bases, such as direct labor hours or machine hours, to ensure they accurately reflect the actual consumption of overhead resources. By refining these allocation methods, companies can achieve more precise cost distribution, leading to better pricing strategies and cost control. Carbonic Corporation uses an overhead application rate that resulted in $15,000 of excess overhead being charged to produced units during its March reporting period.

If the actual overhead had come to $270,000, the company would have charged off more than was necessary, and it would have “overapplied overhead” of $18,450. Note that the preliminary estimate of overhead costs, $250,000, doesn’t factor in here. In cost accounting, managing overapplied overhead is a critical task that can significantly influence an organization’s financial health. Overapplied overhead occurs when the allocated manufacturing overhead costs exceed the actual incurred costs during a specific period. This discrepancy can lead to distorted financial statements and misinformed decision-making if not properly addressed.

- One strategy is to refine the predetermined overhead rate by using more accurate and dynamic allocation bases.

- This can affect a company’s perceived financial health and may influence decisions related to pricing, budgeting, and resource allocation.

- Kraken Boardsports had 6,240 direct labor hours for the year and assigns overhead to the various jobs at the rate of $33.50 per direct labor hour.

In this case, the manufacturing overhead is overapplied by $500 ($10,000 – $9,500) as the applied overhead cost is $500 more than the actual overhead cost that have occurred during the period. To correct for overapplied overhead, the excess amount is usually subtracted from the total cost of goods sold. If the amount of overapplied overhead is significant, it may be spread out across various inventory accounts and cost of goods sold in proportion to the overhead applied during the period. On the other hand, if the manufacturing overhead has a credit balance it means that that the applied overhead is more than the actual overhead.

To determine overapplied overhead, one must first understand the components involved in overhead allocation. Overhead costs include indirect expenses such as utilities, depreciation, and maintenance, which are not directly traceable to specific products. These costs are allocated to products using a predetermined overhead rate, often based on direct labor hours, machine hours, or another activity driver. This rate is established at the beginning of the accounting period based on estimated overhead costs and estimated activity levels.