What are Suspense Accounts: Definition and Examples

In balance sheet terms, a suspense account is not ideal, as it can prevent you from accurately balancing the books. However, in your day-to-day business activities, using a suspense account in accounting is much like placing a document on a “to file” pile. A suspense account is needed because the appropriate account was not determined at the time the transaction was being recorded. suspense account in balance sheet As long as a transaction is found in a suspense account and hasn’t yet been transferred to its permanent account, it is placed in the suspense account, acting as its holding account for the transaction. Having a larger number of unreported transactions would mean that it won’t be recorded by the end of the reporting period, resulting in inaccurate financial outcomes.

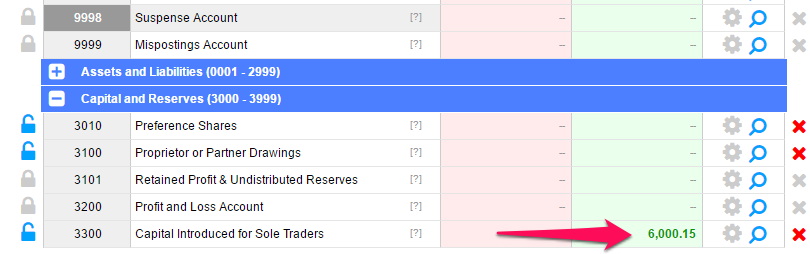

Example 1: Incorrect Entries

A suspense account is a temporary holding account for a bookkeeping entry that will end up somewhere else once the final and correct account is determined. A suspense account is an account used to temporarily store transactions for which there is uncertainty about where they should be recorded. Once the accounting staff investigates and clarifies the purpose of this type of transaction, it shifts the transaction out of the suspense account and into the correct account(s). Explore the strategic role of suspense accounts in accounting, their resolution, and how they ensure accurate financial reporting.

Suspense Account: Definition, Example, Creation, And Close

They serve as a holding pen for financial amounts that cannot be immediately classified into the standard chart of accounts due to incomplete data or uncertainty regarding their proper placement. This temporary assignment prevents the premature recording of financial activity in a way that might necessitate later corrections, which can be both time-consuming and costly. A suspense balance mortgage refers to a temporary account where incomplete or unclear mortgage payments are held.

- The difference amount is temporarily recorded in a suspense a/c and should be cleared at some point as it possesses a control risk.

- Well-documented transactions reduce the likelihood of errors, facilitate reconciliation processes, and expedite the resolution of any discrepancies.

- Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

- Just like any to-do pile, the suspense account cannot hold your mystery amounts forever, and its proper place will need to be determined.

- If the credits in the trial balance exceed the debits, record the difference as a debit–and vice versa–to make both columns of the trial balance report balance.

Great! The Financial Professional Will Get Back To You Soon.

Recording and acknowledging such transactions is essential to ensuring accuracy in financial statements. In case of a “Credit balance”, it is shown on the liability side of a balance sheet. Depending on the transaction in question, a suspense account can be an asset or liability. If it’s an asset in question, the suspense account is a current asset because it holds payments related to accounts receivable. Suspense accounts are essential tools in accounting that enable organizations to temporarily hold and investigate unresolved transactions or discrepancies.

Reconciliation: How to Reconcile Suspense Accounts?

Until you actually make the withdrawal from the agent or financial institution, the remittance money may be stored in their suspense account. He will move the amount from the Suspense account to the appropriate account as soon as he gets more information about the nature of the transaction. Hence this account helped him to keep the transaction in the books of accounts and, at the same time, deter him from putting it under the wrong category. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

Example 3: Unclear Transactions

A suspense account could also be a liability if it holds accounts payables that you don’t know how to classify. Suspense accounts are used when your trial balance is out of balance or when you have an unidentified transaction. The suspense account is a general ledger account that acts as a holding account until the error is discovered or the unknown transaction is identified. No, you do not need to close your suspense account as long as you are keeping track of uncorrected transactions. If your business experiences a high rate of change in its accounts, though, it is best practice to close the suspense account periodically and transfer all uncorrected entries to their respective ledger accounts. The continuation of unresolved suspense accounts can result in several potential risks and consequences for organizations.

When the payment is finally made and you receive the asset then you can close your suspense account. If it is the asset in question then the suspense account is considered as a current asset because it keeps the payment that is related to the accounts receivable. Therefore, it is vital to have a process in place to clear out the suspense account on regular basis so that all of the suspense account entries are moved into their designated accounts to zero out the suspense balance. The most important point to understand is that transactions are recorded in the suspense account only temporarily and need to be relocated to their correct permanent accounts as soon as possible.

Suppose a company mistakenly enters a financial transaction into the wrong account due to a data input error. The entry will not reconcile correctly with other related accounts, potentially causing confusion and inconsistencies in financial reporting. In such cases, a suspense account can be used to temporarily hold the transaction until it can be rectified and reclassified correctly. A suspense account is one that temporarily records transactions that have yet to be assigned to their proper accounts. The suspense account is situated on the general ledger and is used to temporarily store specific transaction amounts. Having said that, any sums recorded in this account will ultimately be transferred to another permanent account.

It is, therefore, imperative for organizations to proactively manage and resolve suspense accounts to mitigate these risks effectively. They provide a means for temporarily storing these transactions until their nature is identified or discrepancies are cleared. Suspense accounts are particularly useful in cases where the timing, classification, or allocation of journal entries is uncertain, or when errors or discrepancies have been detected. The accountant will then credit the suspense account with $50 and debit the cash account with the same transaction amount. When the company gets the entire payment from the customer, they will debit $50 from the suspense account and credit the receivable accounts with the same amount.